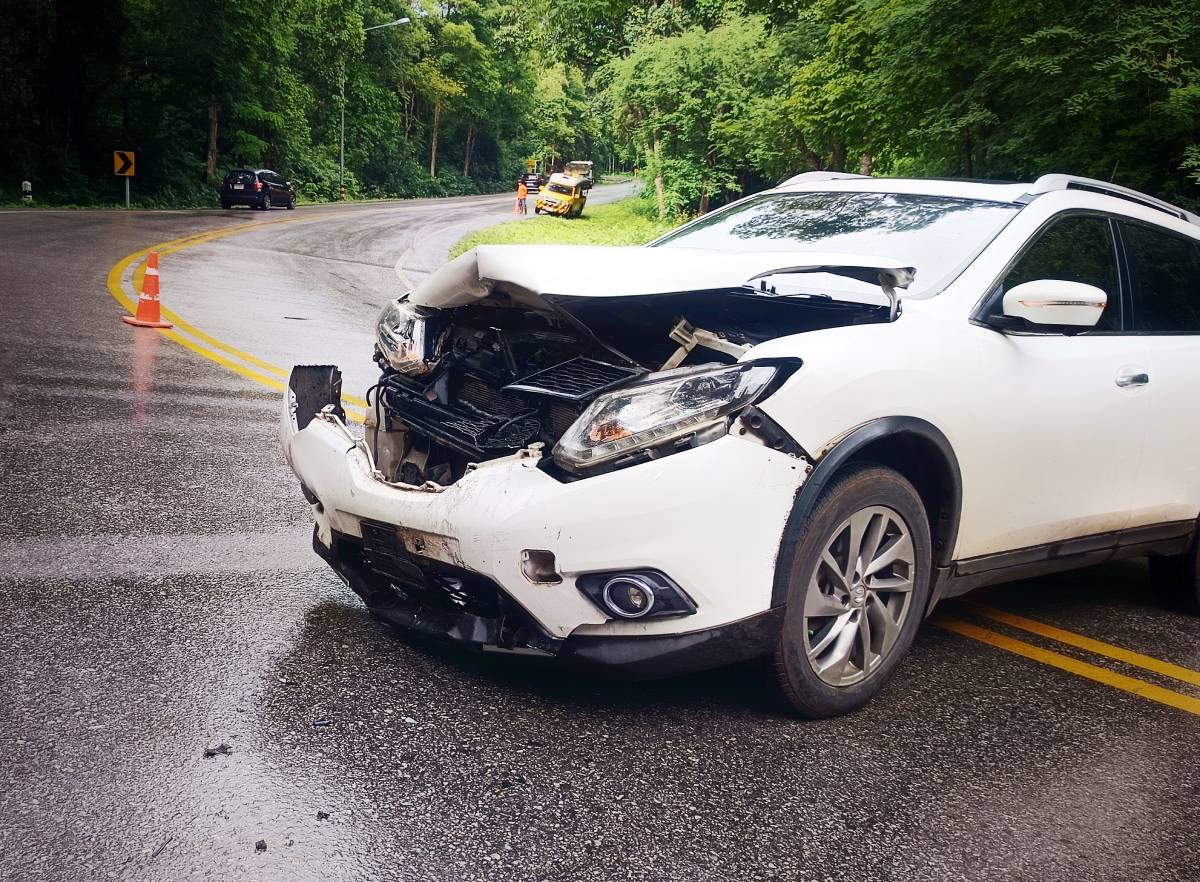

How to Get the Most Money from Insurance for a Totaled Car

If your car has ever been totaled, your next concern is probably the payout. Will it be enough to replace your vehicle? Will your insurance company be fair? And what if the offer feels too low?

The truth is, most insurance settlements for totaled vehicles are negotiable, but the initial offer may not always reflect the full value of your car. While some states impose strict valuation standards that require offers to match the actual cash value and include certain taxes or fees, you still have the right to review the report and dispute comps that don’t accurately represent your vehicle. Knowing how to get the most money from insurance for a totaled car can help you avoid leaving money on the table.

When Is a Car a Total Loss?

Your car is considered a total loss when the repair cost is close to or exceeds its actual cash value (ACV), which is the value the car had before the accident. The proximity required depends on your state.

Many states use a Total Loss Threshold (TLT), which is a fixed percentage of the car’s value. In Texas, insurers may total a car when repairs approach or exceed the actual cash value (ACV). This means an insurer can declare a total loss earlier for economic reasons, but the legal salvage title threshold is stricter. In Florida, if an insurer pays to replace a vehicle, it is deemed a total loss. For uninsured vehicles, it’s considered a loss when repair costs 80% or more of the replacement cost. For late-model cars, a repair estimate of 90% or more triggers a certificate of destruction, making the vehicle un-rebuildable.

Other states follow a Total Loss Formula (TLF). In this case, the insurer compares the repair estimate plus the salvage value to the car’s pre‑accident value. If that total exceeds the ACV, the car is considered a total loss.

For example, if your car is worth $9,000, the repair estimate is $6,500, and the salvage value is $3,000, the total comes to $9,500. Since this exceeds the ACV, the car would be declared a total loss under the Total Loss Formula (TLF), which is used in some states instead of a fixed percentage threshold.

Whose Insurance Pays for the Damages?

Who pays for a totaled car depends primarily on who was at fault.

If the Other Driver Was at Fault

Their liability insurance should cover the damage, including the total loss payout. This is known as a third-party claim. However, you can also choose to file under your own collision coverage for faster resolution, and your insurer will then pursue the other driver’s insurer to recover costs, including your deductible.

All but one state requires drivers to carry liability coverage for this reason. New Hampshire is the only state where drivers can legally drive without it if they meet certain financial responsibility requirements.

If You Were at Fault

Your collision coverage would apply if you have it. This type of coverage is optional and not included in basic liability policies. Even some of the best car insurance companies don’t include it by default.

If the Other Driver is Uninsured or Underinsured

You would usually rely on your collision coverage, since uninsured and underinsured motorist property damage (UMPD/UIMPD) is not available in every state and may come with limits or deductibles where it is offered. These are also optional add-ons, so review your policy to check if you’re covered. If not, consider whether it’s time to switch to a different car insurance provider.

If You Live in a No-Fault State

In a no‑fault state like Kentucky, Personal Injury Protection (PIP) covers injury expenses regardless of fault, with the default limit set at $10,000. But property damage still depends on fault. If you use your collision coverage, your insurer typically pays you directly without waiting for reimbursement from the at‑fault driver’s insurer (subrogation).

Who Receives Payment for a Totaled Car?

Who gets the insurance payout depends on whether you fully own the car or still owe money on it.

If the car is paid off, the insurance company sends the settlement directly to you. You can use the money however you choose, whether to buy a new replacement vehicle or cover other expenses.

If the car is financed or leased, insurers usually issue the check directly to the lender or as a joint check made out to you and the lienholder. In lease situations, the lessor typically receives the settlement. Once the balance is covered, any remainder may be released to you. For example, if your car is worth $9,000 and you owe $6,000, the lender gets $6,000 and you receive $3,000.

If you owe more than the car’s value, you must cover the gap. For instance, if you owe $11,000 on a vehicle valued at $9,000, you are responsible for the $2,000 shortfall. This is where gap insurance helps. It covers the difference between the insurance payout and what you still owe, preventing you from paying out of pocket for a car you no longer drive. While not included in every policy, gap insurance is often part of lease agreements or low-down-payment loans. Bundling it smartly could help you save on car insurance overall.

How Is the Settlement Amount Calculated When a Total Loss Occurs?

Insurance companies follow a total loss valuation process to decide what your car was worth before the accident.

Insurers Use Actual Cash Value, Not Replacement Cost

The payout is based on your car’s actual cash value (ACV) at the time of the accident. This is not the original purchase price or the cost to replace it with a new one. It reflects the vehicle’s age, condition, mileage, and current market value for similar cars in your area.

How Insurers Value Your Car (and How to Check Their Math)

Insurers typically use third‑party valuation vendors (for example, CCC, Mitchell, or Audatex) plus local comparable listings to estimate ACV. They should match year, make, model, mileage, trim, options, and condition. Always request the full valuation report so you can review the comps and adjustments.

Your Deductible Lowers the Final Amount

If you are filing the claim through your policy, your deductible will be subtracted from the total settlement. For example, if your car’s ACV is $10,000 and your deductible is $500, you will receive $9,500. Your deductible is usually subtracted from the payout when you file through your insurance policy.

In many states, insurers are also required to include sales tax, title, and registration fees in a total-loss settlement, so confirm these are accurate in your payout.

Gap insurance can lower any remaining loan balance, and while many policies do not cover your deductible, some gap contracts include ‘deductible assistance’, often up to $1,000.

However, there are some exceptions. For example, in some states, like California, a collision deductible can be waived if you’re not at fault, and if you file through the other driver’s liability coverage, there is no deductible.

Important Details Are Often Missed

Insurance may overlook upgrades or recent maintenance unless you point them out. Valuation systems generally apply condition adjustments rather than reimbursing the full cost of repairs or add-ons. Providing receipts and photos helps justify a higher condition rating.

You Have the Right to Dispute the Offer

Suppose you’re facing an insurance low-ball offer on a totaled car. You can challenge it. Look up similar listings in your area, save the pricing and dates, and gather receipts for recent repairs or upgrades. If the insurer’s comps are not accurate or relevant, disputing can lead to a higher payout.

How to Negotiate Total Loss Payout for Maximum Compensation

Learning how to negotiate with car insurance adjusters about a car total loss can make a big difference in what you receive. Many drivers accept the first offer without knowing they have the right to ask for more.

Ask for the Valuation Report

Always request the valuation report used to calculate your payout. Review the list of comparable vehicles and check whether they match your car’s year, mileage, trim, and condition. If the comps are outdated, poorly matched, or from outside your area, you have to dispute the offer.

Find Strong Local Comparables

Start by searching for similar cars for sale in your area, ideally within a 25 to 50-mile radius. If inventory is limited, valuation vendors may expand the radius significantly, so be prepared to review comps from a wider region. Match the make, model, mileage, and features as closely as possible. Use dealer websites, online listings, and online platforms like AutoTrader or Craigslist. Save the listings with prices and dates to support your case.

Include Maintenance and Upgrades

Provide receipts for recent work, such as tire, brake, battery, or mechanical repairs. Mention any additional features, such as a sunroof, leather seats, or upgraded sound systems. These details may not be included in the insurer’s estimate unless you bring them up. If possible, share photos showing the condition of your car before the accident.

Challenge Inaccurate Comparables

If the insurer used comps that are missing features, in poor condition, or from other regions, explain why they are not a fair match. Knowing how to negotiate with an insurance adjuster using clear evidence and a professional tone often leads to better results. Share your findings and ask for a revised offer if the total loss adjuster refuses to modify the amount; you can escalate to a supervisor or specialist. If you choose to keep your totaled car, the payout is reduced by the salvage value, and the title is branded as salvage or rebuilt, which can affect future insurability and resale. Many policies also include an appraisal clause, which allows each party to hire an appraiser and, if necessary, an umpire to resolve valuation disputes without going to court.

How Long Does It Take to Get an Insurance Check for a Totaled Car?

Most drivers receive their total loss payout within two to four weeks after the claim is approved. However, the exact timeframe varies by state and claim complexity. For instance, California law requires insurers to accept or deny a claim within 40 calendar days of receiving proof of claim, and total-loss settlements must include tax and title fees.

Responding quickly to your insurer and having key information, such as your car insurance policy number, ready helps expedite the process. Delays often happen due to missing paperwork, slow responses from lenders, or incomplete title information. Having everything ready early can help avoid unnecessary waiting.

Factors That Affect How Long It Takes to Settle

Most total loss claims are settled within two to four weeks, but certain factors can delay the process. While some delays are unavoidable, understanding their causes can help you stay ahead of them.

Disputes Over Fault

If there is any question about who caused the accident, the claim may be delayed until liability is resolved. This is common in multi-vehicle crashes or when drivers give conflicting accounts. If another driver’s insurer is involved and slow to respond or denies fault, the process can take even longer. Many insurers wait until fault is confirmed before issuing a payout.

Lender or Lease-Related Delays

If your car is financed or leased, your insurer must coordinate with the lender to verify the loan balance and send payment. Lenders often take time to respond to requests for additional documents, which can delay your settlement by several days or weeks.

State Regulations Vary

Some states, like California, have strict timelines that require insurers to settle claims quickly. Others allow more flexibility, which can lead to longer processing times. If your claim is taking too long, ask your adjuster for an update. If you still receive no response, you can file a complaint with your state’s department of insurance.

Maximize Your Totaled Car’s Value

Insurance companies expect you to negotiate, and now you know how to get more money from insurance for a totaled car. The more prepared you are, the better your payout will be. Negotiate, research, challenge low offers, and ensure your settlements accurately reflect the actual value of your car. Also, knowing the different types of car insurance can help you protect yourself during a total loss claim.